Press Releases Archive

Shimon Shkury

President and Founder

Ariel Property Advisors

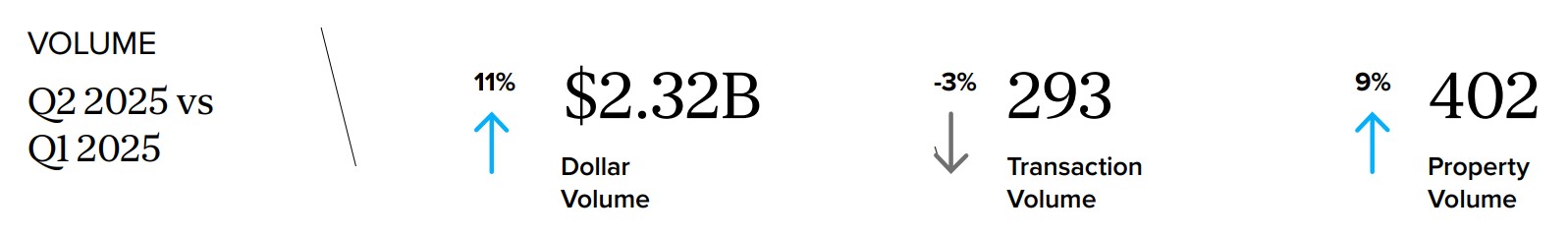

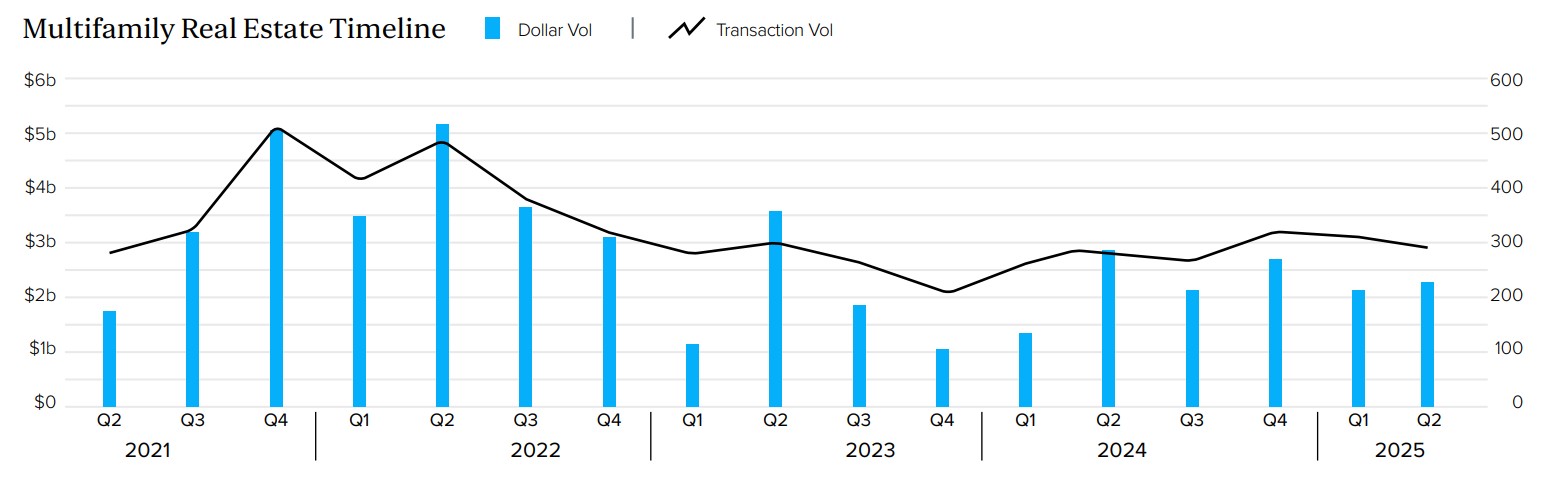

NEW YORK, NY – July 17, 2025 – New York City’s multifamily market rose to $2.3 billion in Q2 2025, up 11% from Q1 2025, while transactions fell a slight 3% over the period to 293, according to Ariel Property Advisors Q2 2025 Multifamily Quarter in Review New York City.

Investment in the affordable housing sector accounted for 41% of overall multifamily dollar volume, the highest mark since Nuveen’s acquisition of Omni’s Affordable Housing Platform in Q2 2023, followed by rent stabilized properties at 32% and predominantly free market buildings at 27%.

“Q2 reflected a resilient multifamily market navigating complexity,” said Shimon Shkury, President and Founder of Ariel Property Advisors. “Capital continues to flow into affordable housing and rent-stabilized assets for very different reasons—mission-driven investment versus distress-driven sales—while demand for free-market properties remains strong. Brooklyn led the charge, and recapitalizations on high-quality assets underscore deep institutional confidence despite political and policy headwinds.”

Submarket Highlights

Brooklyn

Bronx

Manhattan

Queens

Northern Manhattan

The full Q2 2025 Multifamily Quarter in Review New York report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.