Read The Article on Brooklyn Daily Eagle

Strategic upzonings, New York City's efficient subway network, and an influx of young people have all contributed to the development surge in Brooklyn's northern neighborhoods, while other parts of the borough have been virtually ignored by developers.

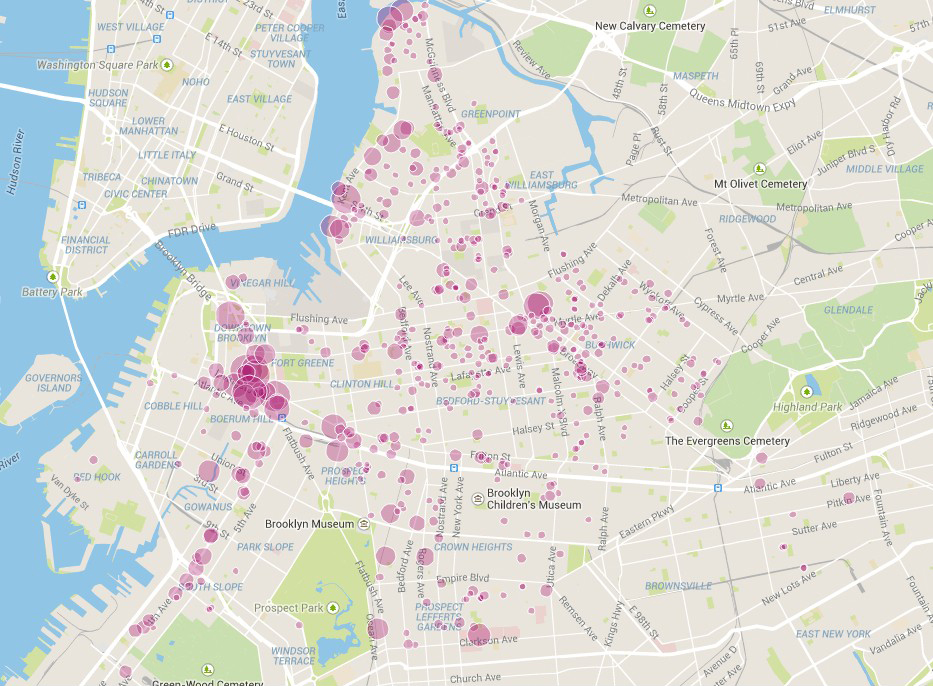

An Ariel Property Advisors' study of permits filed with the NYC Buildings Department in 2013 and 2014 confirms that development is booming in the areas that were rezoned by the city 10 to 12 years ago including Downtown Brooklyn, Williamsburg/Greenpoint, and Fourth Avenue; in mega developments such as Pacific Park in Prospect Heights and the Rheingold Brewery complex in Bushwick; and in the smaller, mostly vacant lots found in Crown Heights, Bedford Stuyvesant, and Bushwick. The study reviewed 670 permit applications for residential projects with six or more units.

The city is now hoping that if its proposed East New York rezoning plan is implemented, developers will focus their attention on the eastern part of Brooklyn and unleash the same type of building boom the borough has seen in other rezoned neighborhoods.

The Department of City Planning is expected to certify the East New York rezoning application soon, which will kick off a public review of the initiative. The rezoning proposal includes plans to allow 12-14 story mixed-use development on about 30 blocks along Atlantic Avenue from roughly Pennsylvania Avenue to Conduit Boulevard, and will require that all new construction include affordable housing. New zoning also would allow 6-8 story residential and retail uses on Fulton Street; 8-10 story buildings on Pitkin Avenue; and 6-8 story buildings on Liberty Avenue. The Planning Department estimates that the rezoning could encourage the construction of between 5,000 and 7,000 new units in the next 15 years along the corridor, which runs parallel to the A, C, J, Z, and L subway lines that converge at the Broadway Junction.

So far, East New York hasn't attracted the attention of developers and only a handful of building permit applications were filed in the neighborhood during the two-year period we reviewed. One exception was a permit for Gateway Elton Street, a 659-unit affordable development with ground floor retail near Gateway Center that the Hudson Companies is building. The developer filed a permit last year for a 136-unit residential building at 1062 Elton Street that will be part of the complex.

Brooklyn Borough President Eric Adams also is committed to building affordable housing in the borough and filed a recommendation with the Planning Commission last year to allow developers to build up to 10 stories on a four-mile stretch of Broadway running through Williamsburg, Bushwick, Ocean Hill, and Bedford Stuyvesant. Even without upzoning, development is occurring organically along this corridor. Our analysis shows that permits have been filed for clusters of residential developments on Broadway around DeKalb, Myrtle, and Flushing Avenues, and for the massive Rheingold development site just a block off Broadway.

Brooklyn's development site sales in 2014 mirrored the 2013-14 building permit filings, Ariel Property Advisors' Brooklyn 2014 Sales Report shows. Nearly 460 development sites totaling more than 9.8 million buildable square feet of development sites traded in Brooklyn last year for over $1.8 billion, accounting for nearly a third of all the $6 billion in investment property dollars spent in the borough last year.

Of last year's trades, only two development sites sold in East New York including an M1-1-zoned site with 428,550 buildable square feet that sold for $40 million at 830 Fountain Avenue, where the ownership is reportedly planning a FedEx distribution facility.

Compare this activity to Downtown Brooklyn, where 26 development properties totaling over 932,000 buildable square feet valued at over $203 million traded and permits were filed for 20 residential towers, or the trendy neighborhood of Williamsburg, which had more development site sales than any other Brooklyn neighborhood. Williamsburg saw 82 properties totaling over 1.25 million buildable square feet sell for close to $400 million.

Major projects are planned for Kent Avenue in Williamsburg, including the mammoth 2,300-unit, mixed-use Domino Sugar factory development at 325 Kent Avenue; an 18-story, 179-unit and 22-story, 270-unit complex at 420-430 Kent Avenue; and a 216-unit residential development with amenities at 429 Kent Avenue.

In Greenpoint, 27 properties with close to a million buildable square feet sold last year for nearly $155 million. The Greenpoint waterfront will undoubtedly become one of the city's most rapidly-changing neighborhoods over the next few years. The sale of a 179,000 buildable square foot site at 161 West Street in Greenpoint for $45.5 million exemplifies this trend. Over 200 condos will reportedly be built on this site, which is south of Greenpoint Landing where about 5,500 units in 10 towers are planned.

Parts of North Brooklyn, waterfront areas in particular, are now competing with Manhattan-level prices while neighborhoods further inland are increasingly catching up.

Last year, investment dollars for smaller development sites poured into Crown Heights, Bedford-Stuyvesant, and Bushwick, three neighborhoods where demand for multifamily properties is high, subway access is excellent, and hip restaurants, cafes, and shops are opening at a rapid clip. Last year, Crown Heights saw 21 development sites trade for $96 million; Bedford-Stuyvesant saw 39 development properties trade for $89.6 million; and Bushwick saw 33 development properties trade for $48.9 million.

Demand continued to push up land values in 2014 in Crown Heights, Bedford Stuyvesant, and Bushwick, which is a testament to their evolution into mature residential markets. One illustrative trade occurred at 1036 Dean Street, which sold for $17.5 million, or $230 per buildable square foot as-of-right, without an inclusionary housing bonus.

Whether East New York rezoning becomes a reality and leads to the neighborhood emerging as Brooklyn's next “hot” neighborhood remains to be seen. City agencies have been meeting with East New York residents in recent months to discuss the rezoning proposal and this dialogue will continue through the public review process, which will culminate with a City Council vote.

Ariel Property Advisors' Brooklyn 2014 Sales Report tracks all development, multifamily, industrial, and other commercial property sales. For a copy of the report, please visit our research reports.

More information is available from at ext. or e-mail .

For a copy of the report, please see http://arielpa.nyc/research/report-APA-Brooklyn-2014-Sales-Report.