May 8, 2017

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely anticipated, left its benchmark lending rate, currently ranging between 0.75% and 1%, unchanged last week. The central bank's policy-setting arm said recent weak economic data would not change its plans to go ahead with steady rate increases this year, noting in a statement that tepid growth earlier this year was “likely to be transitory.“

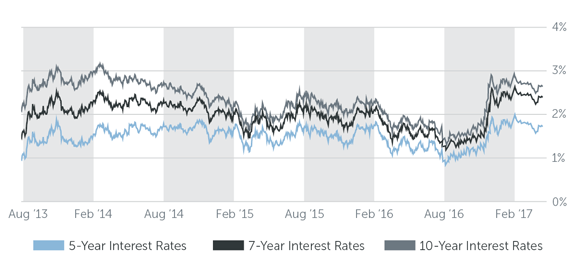

The economy expanded at the slowest pace in three years in the first quarter, with gross domestic product, the value of all goods and services produced, rising a paltry 0.7% annualized rate. Reduced expectations for higher growth and inflation, as well as geopolitical events, have prevented 10-year Treasury yields, last trading at 2.31%, from piercing a two-year high of 2.61% reached in March. Most analysts, however, expect the economy to rebound in the second quarter as seasonal factors subside, and strong jobs numbers posted in April, with unemployment at its lowest point in 10 years, seem to point in this direction.

Economic indicators in the coming months will be pivotal in the Fed's decision of when to raise rates, and investors will be watching these figures closely. Of note, lenders and investors alike will be closely monitoring GDP growth figures and whether or not the tepid figures posted last quarter are indeed only a temporary anomaly, as the Fed anticipates, or if they persist further into the year.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 05/08/2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.50% - 4.00% |

| 7 Year | 3.75% - 4.25% |

| 10 Year | 4.00% - 4.50% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 4.75% - 6.25% |

| Stabilized | 4.75% - 7.00% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 05/08/2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.90% |

| 7-Year Treasury | 2.17% |

| 10-Year Treasury | 2.36% |

| Prime Rate | 3.75% |

| Term | Interest Rates |

| 3-Year Swap | 1.76% |

| 5-Year Swap | 1.97% |

| 7-Year Swap | 2.11% |

| 10-Year Swap | 2.28% |

Pricing current as of 05/08/2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.