March 21, 2019

By Remi Mandell, Ariel Property Advisors

The Federal Reserve, signaling concerns about slowing growth, pared back their projected interest-rate increases, announcing there would be zero rate hikes in 2019, keeping its benchmark short-term interest rate unchanged at between 2.25% to 2.50%. In a statement following a two-day policy-setting meeting, the Federal Open Market Committee said it will be “patient” amid “global economic and financial developments and muted inflation pressures.” The Fed also said it would drawdown the central bank’s bond holdings at the end of September.

The Fed increased interest rates four times last year, but as financial markets became more unstable toward the end of 2018, the central bank announced they would take a more patient approach to monetary policy.

Indeed, looking at a broad measure of the consumer price index, prices rose 1.5% in February from a year earlier, the slowest pace since September 2016. The producer price index, which gauges the prices that businesses receive for their goods and services, climbed 0.1% during the same time span versus the 0.2% that economists had been expecting.

While the economy is on solid footing, the government’s shutdown earlier this year should dampen first quarter gross domestic product. The Federal Reserve Bank of Atlanta’s “GDP Now,” widely viewed as one of the most reliable predictors of GDP, is currently expecting economic output of 0.4% in the first quarter. U.S. growth fared better than expected during the fourth quarter of 2018, with GDP at 2.6%, down from the 3.4% growth rate in the third quarter, but better than the 2.2% that economists has been predicting.

The European Central Bank, in a move to stimulate growth in the euro zone, surprised markets earlier this month by announcing plans to hold interest rates at current levels at least through the end of the year, extending longer than it previously gestured. The ECB also unveiled a plan to issue new, cheap long-term loans for banks starting in September, an incentive it has not used for three years. The ECB’s announcement positively impacted U.S. government bonds because lower yields on European government bonds make higher yielding Treasuries more appealing.

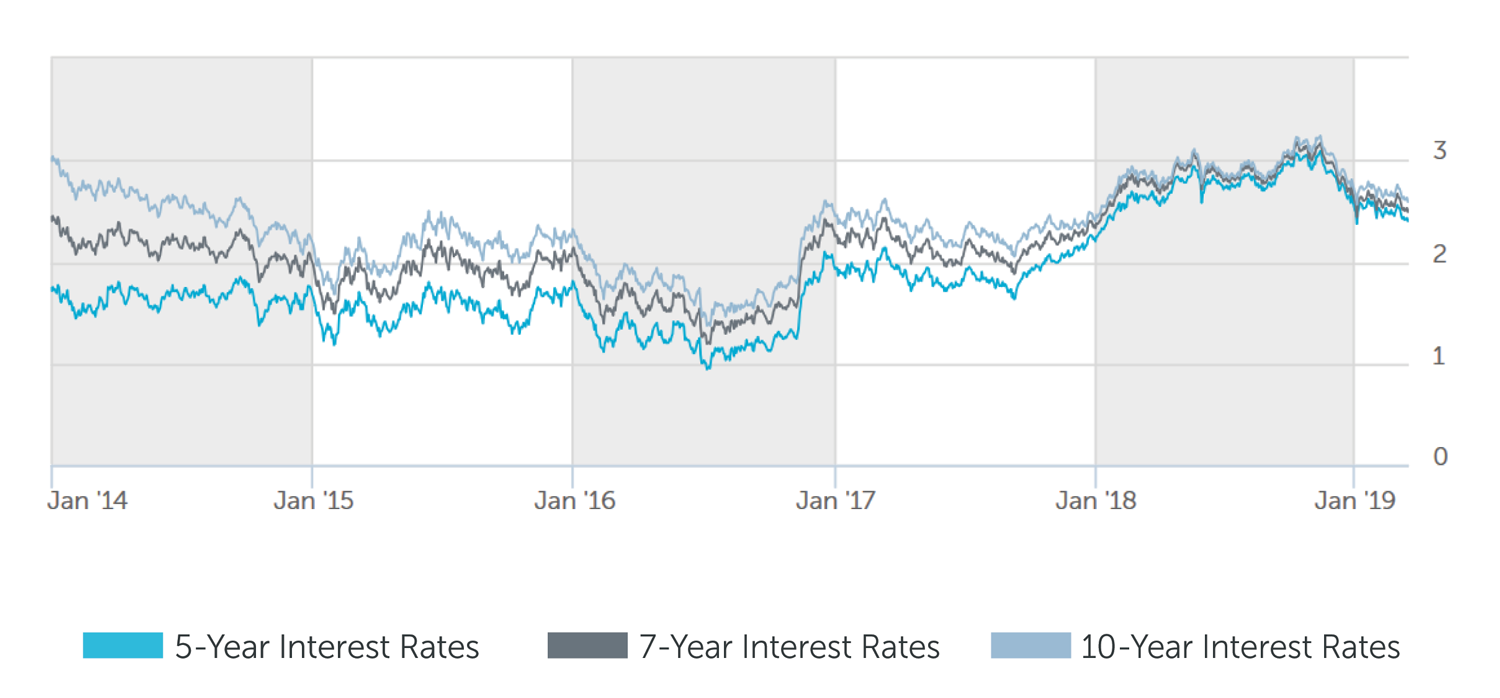

The 10-year Treasury yield – which influences everything from mortgage rates and small business loans to state/government bonds and corporate loans – was last trading at 2.55%, down nearly 70 basis points since hitting a seven-year high last November. Yields could head higher should inflation, which diminishes the value of the fixed-payments made on long-dated bonds, pick up.

“It has certainly become cheaper to finance commercial real estate transactions since December 2018, so investors should pay close attention to economic movements because many balance sheet lenders price their loans daily, based off of a spread over Treasuries,” Weisblum said.

As the Federal Reserve takes a wait-and-see approach to monetary policy, real estate investors remain interested in financing and the lending environment is active. Borrowers across the country, investing in various asset classes, can choose from a countless amount of capital providers, while also enjoying relatively low rates.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 4.125% - 4.375% |

| 7 Year | 4.375% - 4.625% |

| 10 Year | 4.625% - 4.875% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.32% - 4.51% |

| 7 Year | 4.48% - 4.65% |

| 10 Year | 4.64% - 4.80% |

Pricing current as of March 20, 2019 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.50% - 4.75% |

| 7 Year | 4.75% - 5.00% |

| 10 Year | 5.00% - 5.25% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% - 7.00% |

| Stabilized | 6.50% - 8.00% |

| Value Add | 7.00% - 9.00% |

| Re-Position | 9.00% - 11.00% |

Pricing current as of March 20, 2019 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.42% |

| 7-Year Treasury | 2.51% |

| 10-Year Treasury | 2.60% |

| Prime Rate | 5.50% |

| 1-Month LIBOR | 2.49% |

| Term | Interest Rates |

| 3-Year Swap | 2.493% |

| 5-Year Swap | 2.462% |

| 7-Year Swap | 2.504% |

| 10-Year Swap | 2.600% |

Pricing current as of March 20, 2019

TREASURY RATES

More information is available from Remi Mandell at 212.544.9500 ext.33 or e-mail rmandell@arielpa.com.