Press Releases Archive

Jason M. Gold

Senior Director - Investment Sales

Ariel Property Advisors

Daniel Mahfar

Director - Investment Sales

Ariel Property Advisors

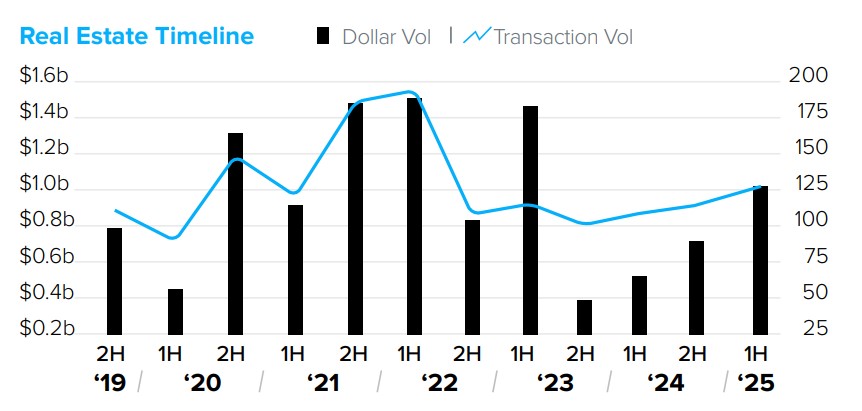

NEW YORK, NY – July 23, 2025 – The Bronx investment sales market experienced a significant recovery in the first half of 2025 with dollar volume rising to $1.07 billion and transactions to 126, year-over-year increases of 106% and 18%, respectively, according to Ariel Property Advisors’ Bronx 2025 Mid-Year Commercial Real Estate Trends report.

"Institutional investors are decisively re-entering the Bronx market, driving the most significant sales volume we've seen since the first half of 2022,” said Senior Director Jason Gold. “Much of this activity stems from the multifamily sector, where pressure on owners of rent-stabilized assets is creating compelling opportunities for well-capitalized buyers to acquire properties at a favorable basis."

Director Daniel Mahfar continued, "The long-term outlook for the Bronx is exceptionally bright, thanks to a powerful convergence of factors. Pro-housing policies like City of Yes and the 485-x abatement are laying the groundwork for development, while the transformative $3 billion Metro-North expansion will anchor the borough as a hub for future growth and investment."

Multifamily Highlights

Development Highlights

Industrial Highlights

Ariel Property Advisors’ Bronx 2025 Mid-Year Commercial Real Estate Trends report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.