Press Releases Archive

Howard Raber, Esq.

Director - Investment Sales

Ariel Property Advisors

Michael A. Tortorici

Founding Partner

Ariel Property Advisors

Christoffer Brodhead

Senior Director - Investment Sales

Ariel Property Advisors

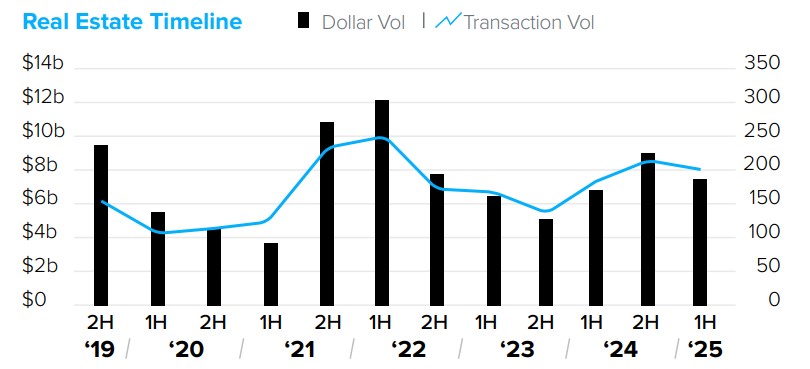

NEW YORK, NY – July 24, 2025 – Manhattan’s real estate market demonstrated resilience and modest growth in the first half of 2025, with $6.81 billion in dollar volume, a 4% increase year-over-year across 200 transactions, according to Ariel Property Advisors’ Manhattan 2025 Mid- Year Commercial Real Estate Trends report .

“Office was the top-performing asset class in Manhattan during the first half of 2025 as leasing rebounded due to demand for Class A space by law, tech and financial firms,” said Ariel Director Howard Raber. “Over 6.71 million square feet of office space traded hands, driven by trophy sales, recapitalizations and targeted value-add plays.”

Founding Partner Mike Tortorici added, “Manhattan also saw acquisitions for office-to-residential conversions in the first half of the year, a trend supported by the City of Yes, 467m tax abatement and proposed Midtown South rezoning. These pro-growth policies are significant and will lay the groundwork for a surge of new housing across the city."

Senior Director Chris Brodhead continued, “In the multifamily space, free market assets accounted for 91% of multifamily dollar volume and 81% of transaction volume in Manhattan. The fundamentals for these assets remained strong with rents rising, vacancies at historic lows and private equity and family offices targeting both core and value-add plays.”

Office Highlights

Multifamily Highlights

Development Highlights

Retail Highlights

Hotel Highlights

Ariel Property Advisors’ Manhattan 2025 Mid-Year Commercial Real Estate Trends report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.