Press Releases Archive

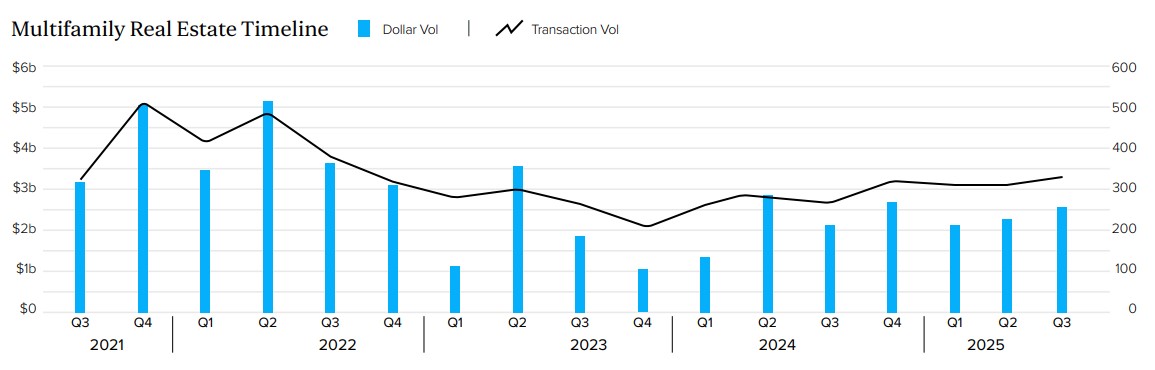

NEW YORK, NY – October 17, 2025 – New York City’s multifamily market gained momentum in the third quarter, rising to $2.55 billion in sales, up 14% quarter-over-quarter and 17% year-over-year, according to Ariel Property Advisors’ Q3 2025 Multifamily Quarter in Review New York City.Transactions totaled 331, up 7% from Q2 2025 and up 23% from Q3 2024.

Nearly half of the dollar volume in the third quarter was in Manhattan where sales were dominated by well-capitalized investors targeting high-value free-market multifamily assets. The quarter’s two largest trades included GO Residential Real Estate Investment Trust’s acquisition of an approximately 30% stake in a three-building Upper East Side luxury multifamily portfolio for $352.2 million, and JP Morgan’s acquisition of a 44-story, 422-unit luxury apartment building at 560 West 43rd Street for $243.5 million.

“Investors continue to favor free-market multifamily buildings, which made up 84% of New York City’s dollar volume in Q3,” said Shimon Shkury, President and Founder of Ariel Property Advisors. “Regulatory flexibility, rent growth and steady demand keep driving that strength, while rent-stabilized assets remain challenged since HSTPA.”

The New York City mayoral election was at the top of the report’s Watch List, noting that Democratic primary winner and current frontrunner Zohran Mamdani has built his campaign around a pledge to implement a rent freeze on all rent-stabilized apartments citywide. This has sparked significant concern among investors and landlords who are calculating how 0% rent growth could affect valuations, underwriting and investment strategies.

Submarket Highlights

Manhattan

Brooklyn

Northern Manhattan

Queens

The Bronx

The full Q3 2025 Multifamily Quarter in Review New York report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.