Press Releases Archive

Sean R. Kelly, Esq.

Partner

Ariel Property Advisors

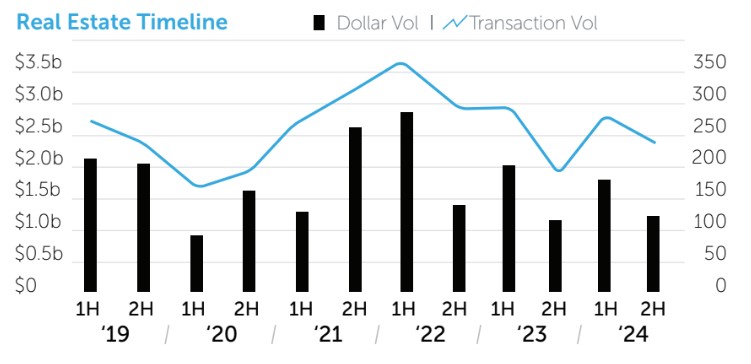

NEW YORK, NY – February 12, 2025 – Investment sales in Queens totaled $2.95 billion in 2024, a 7% year-over-year decline, while transactions rose 5% to 507 over this period, according to Ariel Property Advisors’ Queens 2024 Year-End Commercial Real Estate Trendsreport.

“One of the largest transactions in Queens last year was Terreno Realty’s acquisition of an industrial portfolio for $246 million, an indication that investors view this asset type as a stable investment with room for growth,” said Ariel Partner Sean R. Kelly, Esq. “The transaction also underscores confidence in the JFK area, where a $19 billion public-private redevelopment is transforming the airport into a world-class hub, fueling economic growth and supporting 149,000 jobs.”

Multifamily Highlights

Industrial/Warehouse/Storage Highlights

Retail Highlights

Development Highlights

Ariel Property Advisors’ Queens 2024 Year-End Commercial Real Estate Trends report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.